Why Gomyfinance.com Is Your Ultimate Saving Money Companion

So, here’s the deal: saving money ain’t always easy, but it’s definitely worth it. Whether you’re trying to build an emergency fund, plan for retirement, or just cut down on unnecessary expenses, gomyfinance.com has got your back. This platform isn’t just another boring financial website; it’s like having a personal finance coach in your pocket, ready to help you save smarter, not harder.

Imagine this: you’re scrolling through the internet, looking for ways to make your money work for you. You stumble upon gomyfinance.com, and suddenly, everything starts making sense. It’s like they’ve cracked the code to personal finance and wrapped it up in a super user-friendly package. This site is all about empowering you to take control of your money, and trust me, that’s something everyone needs.

Now, let’s be real for a second. We’ve all been there—spending more than we should, not keeping track of our expenses, and feeling like we’re stuck in a never-ending cycle of bad financial habits. But what if I told you that gomyfinance.com could change all that? With their expert tips, tools, and resources, saving money doesn’t have to feel like a chore anymore. So, buckle up, because we’re diving deep into why this platform is a game-changer.

- Unleashing The Power Of Vegamovies 3 Your Ultimate Streaming Playground

- Bollyflix Movies Your Ultimate Guide To Bollywoods Streaming Sensation

Understanding gomyfinance.com and Its Mission

gomyfinance.com isn’t just another financial blog; it’s a powerhouse of knowledge designed to help you navigate the sometimes confusing world of personal finance. Their mission? To educate, inspire, and empower individuals to make smarter financial decisions. They believe that everyone deserves to have control over their money, and they’re here to provide the tools and resources to make that happen.

What Makes gomyfinance.com Unique?

Let’s break it down. gomyfinance.com stands out from the crowd because:

- It offers personalized advice tailored to your specific financial situation.

- It’s packed with easy-to-understand guides and tutorials for beginners and pros alike.

- It keeps things fun and engaging, so learning about finance doesn’t feel like pulling teeth.

- It’s constantly updated with the latest trends and strategies in saving money.

See, the beauty of gomyfinance.com is that it’s not just about spitting out numbers and graphs. It’s about helping you understand your money in a way that makes sense to you. And who doesn’t love that?

- Anjali Arora Leaked Mms The Untold Story And What You Need To Know

- Aishah Hasnie Husband A Deep Dive Into Her Love Story And Life

Why Saving Money Matters More Than Ever

Alright, let’s get real about saving money. In today’s world, where costs seem to rise faster than our salaries, having a solid savings plan isn’t just a good idea—it’s essential. Whether it’s medical emergencies, car repairs, or unexpected job losses, life has a way of throwing curveballs when you least expect them. That’s where gomyfinance.com comes in.

Key Benefits of Saving Money

Here’s why saving money is so important:

- Financial Security: A well-funded savings account can protect you from life’s unexpected twists and turns.

- Peace of Mind: Knowing you have money set aside for emergencies can reduce stress and anxiety.

- Future Goals: Whether it’s buying a house, traveling the world, or retiring early, saving money helps you achieve your dreams.

And guess what? gomyfinance.com has all the tools you need to make saving money a breeze. From budgeting tips to investment strategies, they’ve got everything covered.

Top Strategies for Saving Money

So, how exactly do you start saving money? Let’s dive into some top strategies that gomyfinance.com recommends:

Create a Budget

First things first: you need to know where your money is going. Creating a budget is like mapping out your financial journey. It helps you identify areas where you can cut back and redirect that money into savings. gomyfinance.com offers free budgeting templates and guides to help you get started.

Cut Unnecessary Expenses

We’re all guilty of spending money on things we don’t really need. From that daily coffee run to impulse online shopping, those little expenses can add up quickly. gomyfinance.com teaches you how to spot these leaks in your budget and plug them before they drain your wallet.

Automate Your Savings

One of the easiest ways to save money is to automate it. Set up automatic transfers from your checking account to your savings account every month. This way, you won’t even have to think about it. gomyfinance.com provides step-by-step instructions on how to set this up with your bank.

How gomyfinance.com Can Help You Save Money

gomyfinance.com isn’t just about giving you advice; it’s about equipping you with the tools and resources you need to succeed. Here’s how they can help:

Expert Financial Advice

gomyfinance.com is packed with expert advice from seasoned financial professionals. They cover everything from budgeting basics to advanced investment strategies. Whether you’re a beginner or a seasoned saver, you’ll find something valuable here.

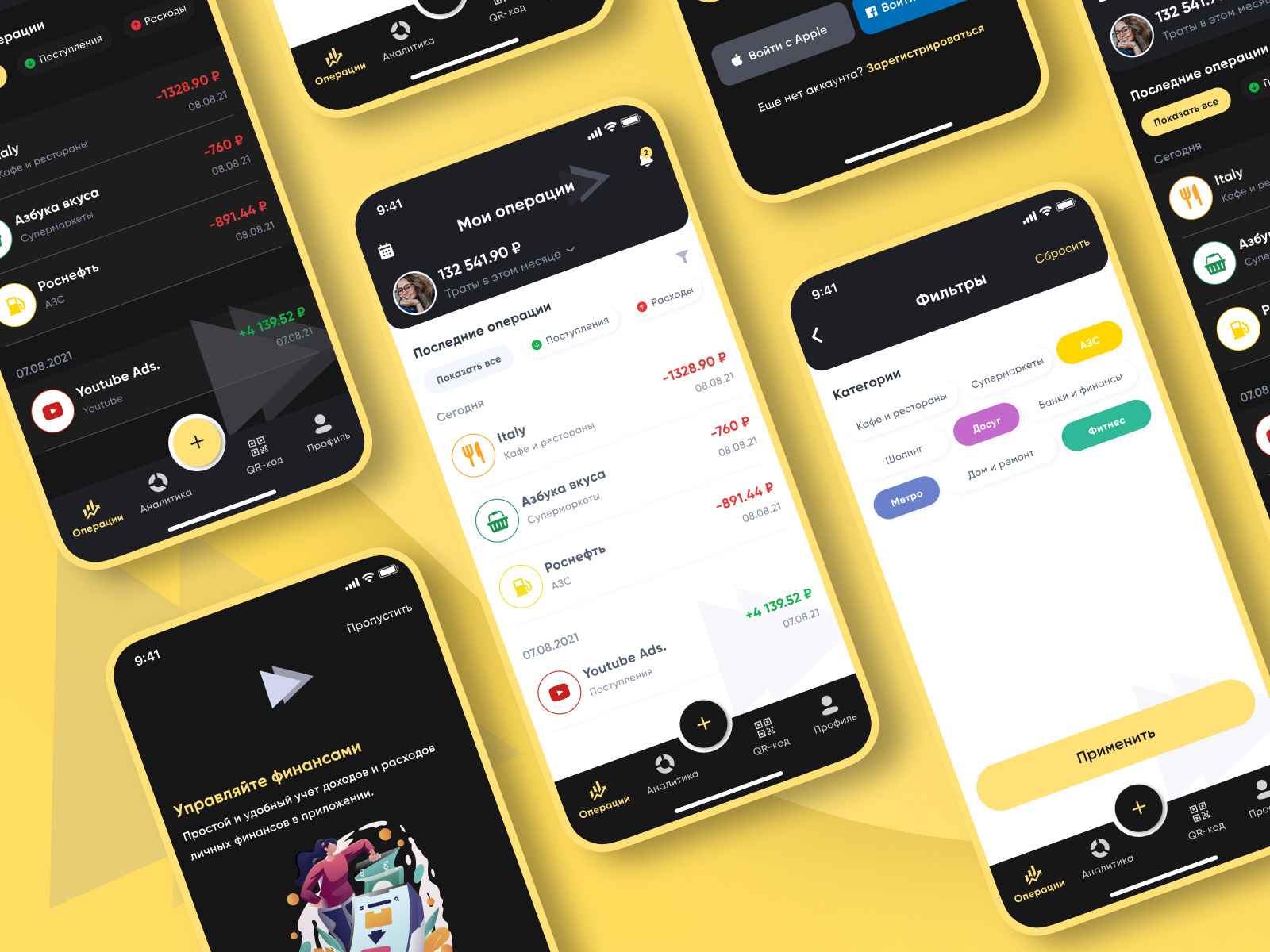

Interactive Tools and Calculators

Sometimes, numbers can be overwhelming. That’s why gomyfinance.com offers interactive tools and calculators to help you make sense of it all. From savings calculators to debt repayment plans, these tools are designed to make managing your money easier and more intuitive.

Community Support

You’re not alone on this journey. gomyfinance.com has a thriving community of like-minded individuals who are all working toward the same goal: financial independence. Join the conversation, ask questions, and share your successes with others who get it.

Common Mistakes to Avoid When Saving Money

Even the best savers make mistakes from time to time. Here are some common pitfalls to watch out for:

Not Having a Plan

Without a solid plan, saving money can feel aimless. gomyfinance.com helps you set clear, achievable goals so you always know what you’re working toward.

Spending More Than You Earn

This one’s a no-brainer, but it’s worth repeating. If you’re spending more than you earn, you’ll never be able to save. gomyfinance.com shows you how to live within your means and make the most of what you have.

Ignoring Your Savings Account

Out of sight, out of mind, right? Wrong. gomyfinance.com reminds you to check in on your savings regularly and make adjustments as needed to stay on track.

Real-Life Success Stories

Sometimes, hearing about real people who’ve succeeded with gomyfinance.com can be the motivation you need. Here are a few inspiring stories:

John’s Journey to Financial Freedom

John was drowning in debt when he discovered gomyfinance.com. By following their advice, he was able to pay off $20,000 in debt in just two years and start building a solid savings account. Now, he’s well on his way to achieving financial independence.

Sarah’s Emergency Fund

Sarah used to live paycheck to paycheck until she started using gomyfinance.com’s budgeting tools. She now has a fully funded emergency fund and is saving for her dream vacation. Her story is proof that anyone can turn their financial situation around with the right tools and mindset.

How to Get Started with gomyfinance.com

Ready to take the first step? Here’s how to get started:

Sign Up for Free

gomyfinance.com offers a free membership option that gives you access to all their basic tools and resources. Simply sign up with your email address, and you’re good to go.

Explore the Resources

Once you’re signed up, take some time to explore the site. Check out their blog for expert tips, download their budgeting templates, and try out their interactive calculators.

Join the Community

Don’t forget to join the gomyfinance.com community! You’ll find support, encouragement, and inspiration from others who are on the same journey as you.

Conclusion

In conclusion, saving money doesn’t have to be a daunting task. With gomyfinance.com by your side, you have all the tools, resources, and support you need to succeed. From creating a budget to automating your savings, this platform makes managing your money easier and more enjoyable than ever before.

So, what are you waiting for? Take that first step today and start your journey toward financial independence. And don’t forget to share this article with your friends and family—because who knows? You might just inspire someone else to take control of their finances too.

Table of Contents

- Why gomyfinance.com Is Your Ultimate Saving Money Companion

- Understanding gomyfinance.com and Its Mission

- What Makes gomyfinance.com Unique?

- Why Saving Money Matters More Than Ever

- Key Benefits of Saving Money

- Top Strategies for Saving Money

- How gomyfinance.com Can Help You Save Money

- Common Mistakes to Avoid When Saving Money

- Real-Life Success Stories

- How to Get Started with gomyfinance.com

- The Dark Truth Behind The Junko Furuta Case A Chilling Story That Still Haunts Japan

- Why Ullu Web Is The Ultimate Destination For Bingewatching

How to use create budget EZ Money Guide

Discover The Power Of Saving With GoMyFinance Com Saving Money App A

Saving Money Guide 2025